One of the most popular enquiry types on LeadCrowd is adverse mortgages. If you’re looking to help more customers with adverse credit achieve their homeownership goals, you’ve come to the right place. Read on to find out more about the leads we can offer.

What type of ADVERSE mortgage leads are available?

LeadCrowd generates a huge volume of bad credit mortgage leads from prospective borrowers with various types of adverse. Some of them are looking to buy their first home, while others are remortgaging or investing in buy-to-let with credit issues holding them back.

We can offer adverse mortgage leads from customers with the following…

-

County court judgements (CCJs)

-

Individual voluntary arrangements (IVAs)

-

Bankruptcies

-

Repossessions

-

Missed or late payments

-

Debt management plans

-

Debt relief orders

-

Limited or no credit history

-

And more

Our adverse credit mortgage enquiries are sourced in real-time and offered to brokers on an exclusive basis. We never sell the same leads to multiple mortgage advisers.

Where our adverse credit mortgage leads come from

They come from various sources and are mostly generated using PPC techniques, with the majority of our bad credit mortgage leads coming from Google Ads campaigns.

There are 2.3 million Google searches carried out every second and the majority of the search pages they return contain Google Ads, which allow advertisers like us to target the most relevant and commercially viable keywords related to bad credit mortgages.

Our bespoke campaigns target more than 10,000 of these keywords to bring in the leads you need. We will manage and optimise these campaigns for you, so all you have to do is wait for high quality leads to pile up in your inbox.

In addition to PPC leads, we also sell SEO leads from our lead providers for an upfront cost.

How Much They Will Cost You

There are two types of leads available to buy from us: PPC leads and SEO leads. Each type has its own pricing structure, terms and conditions attached.

PPC leads

PPC leads are made up of ‘Advertising’ and ‘Lead Costs’ = Variable cost leads.

For PPC leads, you will be billed for your Google advertising spend (billed daily) and for every genuine lead generated (subject to any accepted lead refunds. See lead refund policy for more information).

For this lead type, the average daily advertising cost per lead generated is £15* and we charge £10 for every genuine enquiry generated (lead cost).

Adverse mortgage PPC leads have the added benefit of being able to be location specific e.g. Postcode specific.

*Based on over 250,000 leads generated

SEO leads

SEO Leads DO NOT have any ‘Advertising’ cost and are ‘Lead Cost’ only = Set cost leads.

SEO leads are sold to the highest bidder for an upfront fee and must be purchased on a nationwide basis. For adverse mortgage leads, the cost per lead starts at £25.

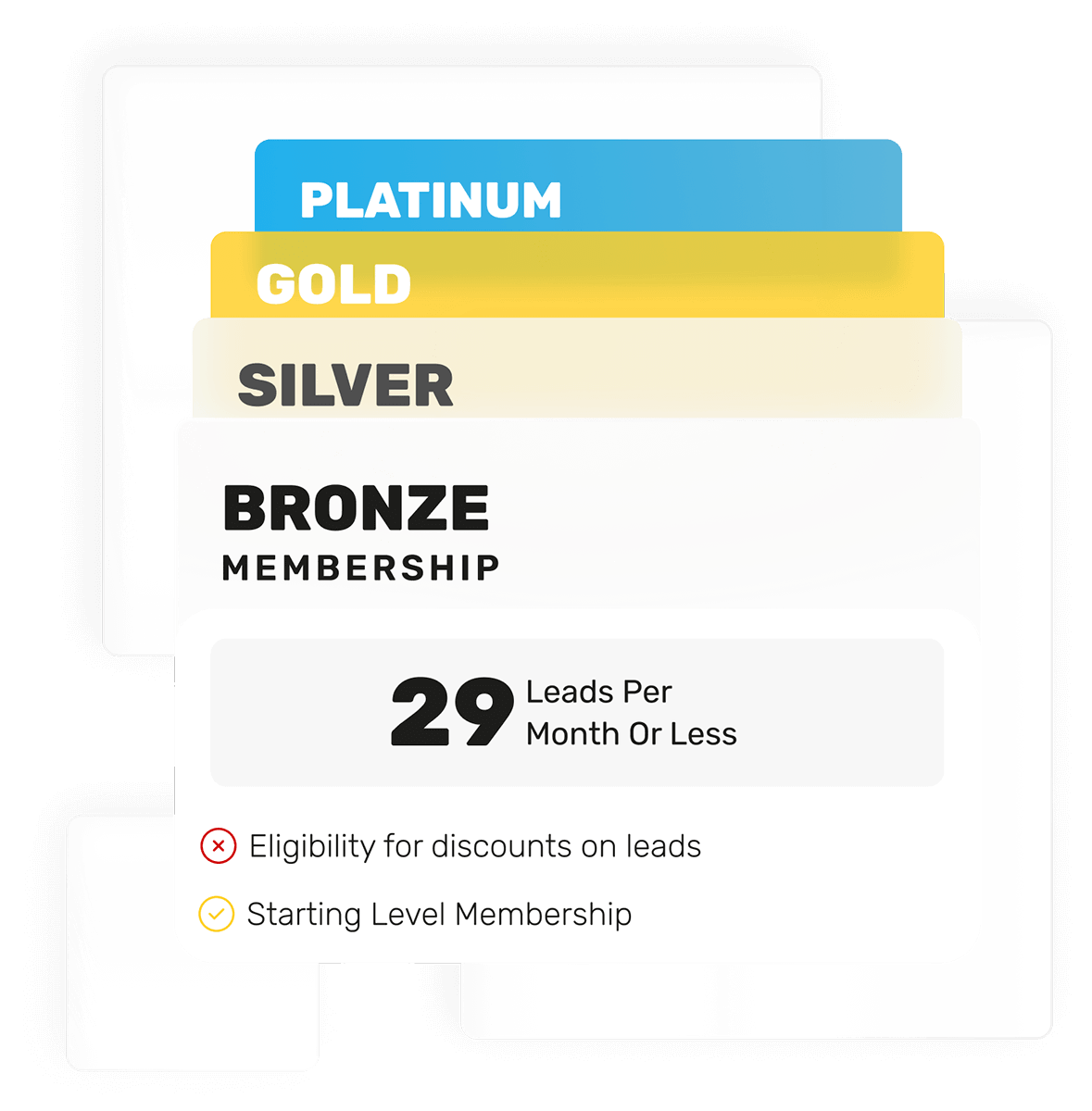

Discounts are available through our Rewards scheme, which offers incentives for customers based on the number of leads they take.

All lead costs cited above exclude VAT

Why use LeadCrowd for your Adverse Mortgage leads?

We are confident that LeadCrowd is the best place to buy Adverse Mortgage enquiries online. Here are just some of the reasons why advisors choose us for their lead gen needs: